Annual results in 2023

On July 21, 2012, an online insider trading prevention training and promotion course was conducted for the chairman of the board and senior executives. The course content included the components of insider trading, coverage and relevant penalties, etc., to enhance directors and all colleagues’ understanding of insider trading. To prevent colleagues from being accidentally involved in insider trading, a link to the animated short film "Preventing and Combating Insider Trading" produced by the Securities and Futures Market Development Foundation is also provided for colleagues' reference.

Target Audience: 63 directors and senior executives of the company.

Content:

- Introduction to insider trading regulations

- Insider trading advocacy manual

- Legal responsibilities of insider trading

Our company enacted the "Anti-Insider Trading Management Rules" on August 15, 2011, and the Board of Directors revised it once on May 12, 2012. On June 14, 2019, the Board of Directors enacted the "Internal Material Information Handling Procedures."

According to Article 10 of the Company’s “Corporate Governance Best-Practice Principles”:

The Company shall attach great importance to shareholders’ right to information, and strictly comply with relevant information disclosure requirements. The Company’s financial, business, insider shareholding, and corporate governance information shall be provided to shareholders on a regular and timely basis through the Market Observation Post System (MOPS) or the Company’s website.

In order to ensure equal treatment of shareholders, material information should be disclosed simultaneously in English.

To safeguard shareholders’ rights and implement the principle of equal treatment, the Company shall establish internal regulations prohibiting insiders from trading securities using material non-public information.

The aforementioned regulations should include stock trading control measures for insiders who have obtained knowledge of the Company’s financial reports or relevant operating results. Such measures shall include, but are not limited to, prohibiting directors from trading Company stock during the 30 days prior to the announcement of the annual financial report and 15 days prior to the announcement of each quarterly financial report.

The insiders are not allowed to trade in the company's marketable securities during the closed period of the financial report announcement in 2024 to 2025.

| Declaration | Financial Quarter | Recipients |

|---|---|---|

| 04/18/2024 | Closed Period for Insider Stock Trading - Approval of 2024 Q1 Financial Report |

All Directors and All Insiders |

| 07/24/2024 | Closed Period for Insider Stock Trading - Approval of 2024 Q2 Financial Report |

All Directors and All Insiders |

| 10/22/2024 | Closed Period for Insider Stock Trading - Approval of 2024 Q3 Financial Report |

All Directors and All Insiders |

| 01/23/2025 | Closed Period for Insider Stock Trading - Approval of 2024 annual Financial Report |

All Directors and All Insiders |

| 04/22/2025 | Closed Period for Insider Stock Trading - Approval of 2025 Q1 Financial Report |

All Directors and All Insiders |

| 07/23/2025 | Closed Period for Insider Stock Trading - Approval of 2025 Q2 Financial Report |

All Directors and All Insiders |

Board and Functional Committee Performance Evaluation Results

Internal Evaluation:

The company passed the "Performance Evaluation Measures for the Board and Functional Committees" on December 26, 108, specifying that the board and functional committees should conduct performance evaluations annually, and at least once every three years, by an external professional independent organization or a team of external expert scholars.

1. Evaluation Object: The scope of the company's board evaluation includes the board, functional committees, and individual director members' performance evaluations.

2. Evaluation Methods: Includes self-assessment by the board, self-assessment by functional committees and board members, peer assessment, appointment of external professional independent organizations, experts, or other appropriate methods for performance evaluation.

3. Evaluation Criteria: The measurement items for the board's performance evaluation should include at least the following five aspects:

(1) Degree of participation in company operations.

(2) Enhancement of the quality of board decisions.

(3) Composition and Structure of the Board of Directors.

(4) Selection and Continuous Education of Directors.

(5) Internal Control.

The measurement items for director members (self or peer) performance evaluation should include at least the following six aspects:

(1) Understanding of company goals and missions.

(2) Awareness of director responsibilities.

(3) Degree of participation in company operations.

(4) Internal relationship management and communication.

(5) Professionalism and continuous education of directors.

(6) Internal Control.

The measurement items for the functional committee performance evaluation should include at least the following five aspects:

(1) Degree of participation in company operations.

(2) Awareness of functional committee responsibilities.

(3) Enhancement of the quality of functional committee decisions.

(4) Composition and member selection of functional committees.

(5) Internal Control.

4. Executing Unit: The Finance Department is the executing unit for the performance evaluation of the company's board and functional committees.

5. Utilization of Evaluation Results: The results of the company's board performance evaluation should be used as a reference basis for selecting or nominating director candidates. The results of director performance evaluations should also be provided to the Compensation Committee as a reference basis for determining director compensation.

The results of the performance evaluation of the Board of Directors and functional committees for the year 2024 have been submitted to the 6th meeting of the 13th Board of Directors held on February 24, 2025, for review.

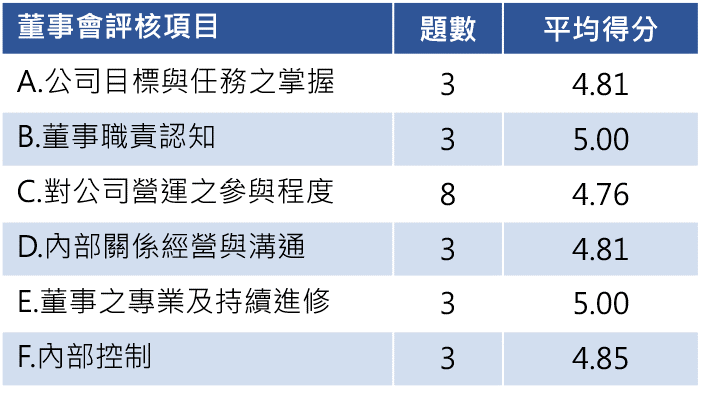

1. Board of Directors and Director (Self or Peer) Performance Evaluation Results

The board of directors, in accordance with corporate governance norms, effectively supervises and communicates, achieves the most accurate resolutions, fulfills the duties of the board of directors, and all directors (including independent directors) have given positive and outstanding evaluations of the efficiency and effectiveness of the board's operations.

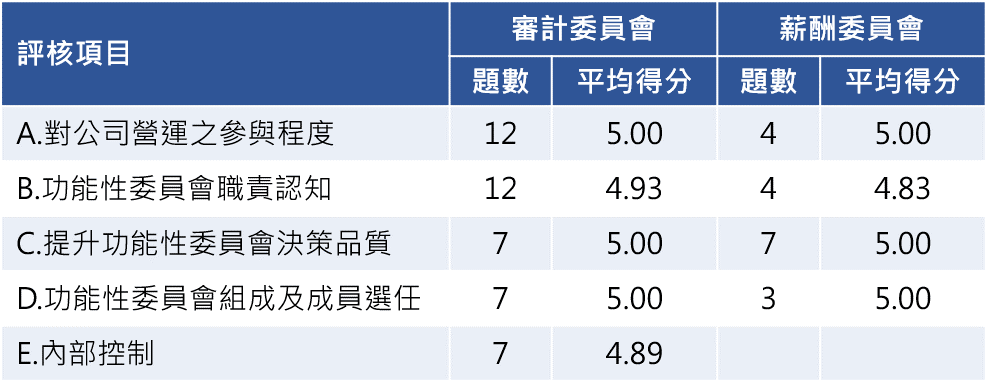

2. Audit Committee Performance Evaluation Results

The independent directors, in accordance with the authority of the audit committee and corporate governance norms, have given positive and excellent evaluations of the efficiency and effectiveness of the audit committee's operations.

3. Compensation Committee Performance Evaluation Results

Members of the compensation committee have given very positive evaluations of the efficiency and effectiveness of the compensation committee's operations, and they mostly agree that both the director members and the compensation committee have fulfilled their functions and complied with relevant laws and regulations.

The results of the internal performance evaluation of the Board of Directors and functional committees are presented below. Each aspect is graded on a scale of 1 to 5, with 5 being the highest score.

The results of the board's performance (including effectiveness) evaluation have been reported at the 12th meeting of the 15th board of directors on February 21, 113.

External Evaluation:

Evaluation Period: FY2023

Date of Execution: December 4, 2023

Date of Report Issuance: February 19, 2024

Evaluation Cycle: Once every three years

Name of External Professional Organization for Evaluation: Taiwan Integrity Management Association

Independence of the External Organization: A non-profit academic professional group currently composed of 40 experts and scholars from various fields. Its main purpose is to conduct research and promote corporate governance, fraud prevention, and forensic expertise in integrity management, based in Taiwan while staying connected with the world.

Evaluation Method: On-site visits, online self-assessment questionnaires

Evaluation Criteria:

(1) Professional competence of the board of directors.

(2) Decision-making effectiveness of the board of directors.

(3) Emphasis on and supervision of internal controls by the board of directors.

(4) Attitude of the board of directors towards sustainable operation.

Evaluation Results:

1. Strengthening the recording of directors' remarks in the board meeting minutes: Board members regularly communicate with the management team. During routine board meetings, directors have thorough discussions on each agenda item, and the opinions and discussions raised by directors during the board meeting are recorded in the board meeting minutes.

2. Increasing the discussion of sustainable development issues in board meetings: Directors are aware of the importance of sustainable development, and the company has established relevant management systems. However, some interviewed directors indicated that the board of directors discusses sustainable development issues less frequently.

Evaluation Recommendations, Company Improvement Plans, and Status:

1. According to Article 17 of the Regulations Governing the Conduct of Meetings of Public Issuing Companies, it is recommended that the evaluated company promptly summarize the opinions and responses provided by the management team and board members before the meeting, as it strengthens compliance and serves as evidence for fulfilling the duties of directors.

2. Continuously strengthen the participation of board members in sustainable development issues, or have the responsible unit for sustainable development regularly report to the board of directors on the implementation of sustainable development policies.